Shortly after our daughter was born, my wife and I signed up for private life insurance. It was a simple decision to insure that our family would be fine financially if something tragic happened to either of us. It was a harder decision to pick a life insurance provider.

We ended up going with Manulife Vitality, because we liked the focus on preventative health. They reward you for staying healthy – with the logic that if you don’t die, they make money. And they offered me a free Garmin watch for signing up, which was a pretty good perk at the time.

Over the past 8 years, I’ve maintained a Platinum status, which I’ve found relatively easy to do as long as I’m exercising one or two days a week, and maximized my perks.

The rewards have been pretty lucrative. Most years I get more back in savings than I pay in premiums.

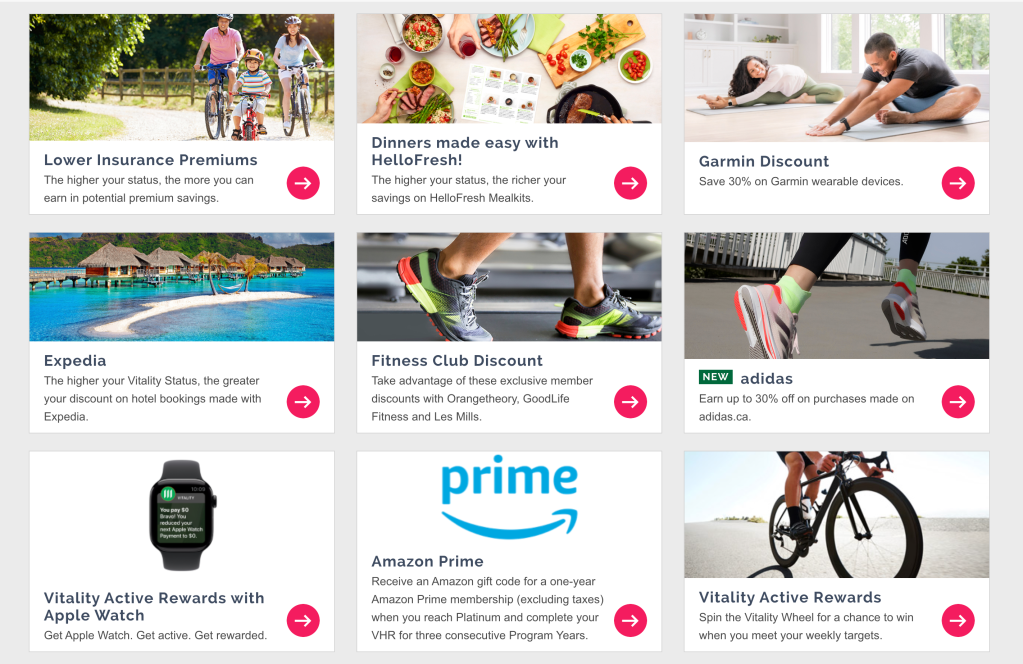

The Rewards

The perks have changed over the years, but have consistently involved travel discounts, smart watches, running shoes or fitness gear, and gift certificates for Amazon.

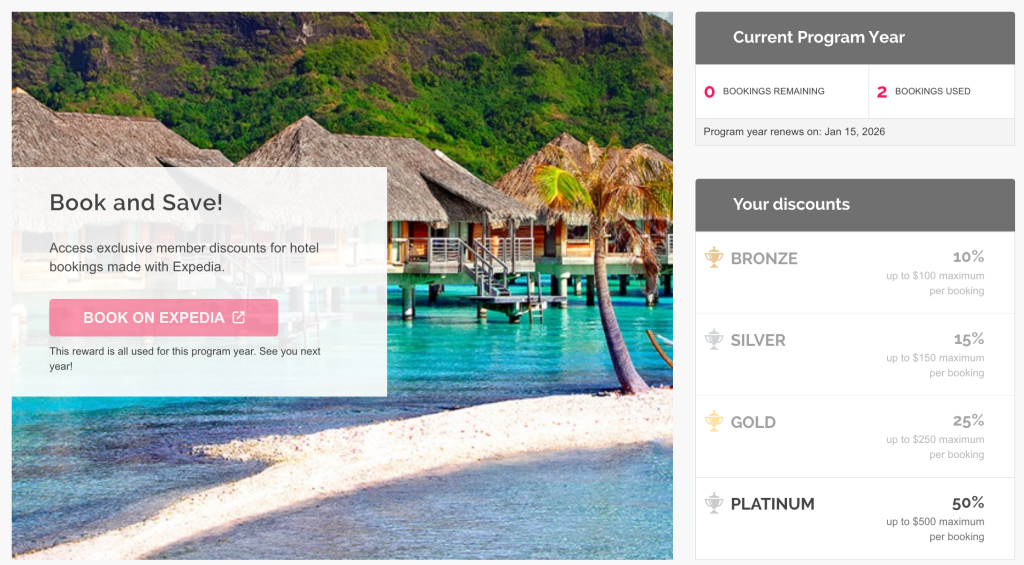

Travel Rewards – Expedia

The hotel rewards are the biggest perk for being a Vitality member. If you keep a Platinum status, you get two 50% off coupons that can be used to save up to $500 each on hotel stays. It’s not always easy to maximize that, but when you do, that is $1000 in savings.

In 2023, I saved $540 on hotels.

In 2024, I saved $445 on hotels.

In 2025, I saved $999 (a trip to Japan makes it a lot easier to maximize).

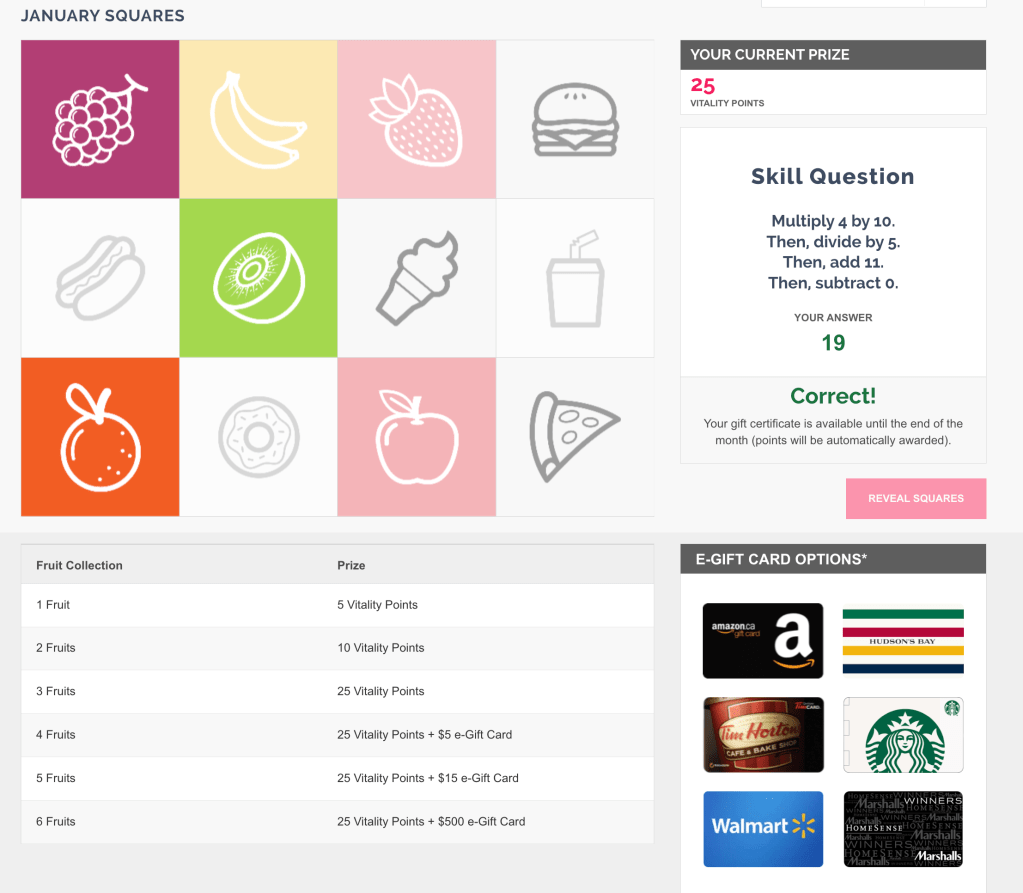

Vitality Squares

Playing the monthly Vitality Squares fruit matching game is the closest thing to free money you get from Vitality. It’s only worth about $28/year (based on the odds of matching more than 3 fruits), but it’s fun to play.

There is also the Vitality Wheel which you can spin whenever you hit your weekly activity goal (given for days with more than 10,000 steps or 30 minute workouts). The goal ratchets up every time you meet it, and slowly drops when you don’t. I’ve managed to earn $65 from wheel spins this year.

Smart Watches – Garmin, Apple, Fitbit

I haven’t bought a watch this year, but we have taken advantage of the 30% off Garmin and Fitbit devices in the past. They also have discounts for Apple Watches.

Fitness Wear – Adidas

I loved this perk when it was with Saucony and used it to by my old marathon trainers. Unfortunately, it switched to Adidas this year and they limit what is eligible for the discount, so it no longer applies to any of the running shoes.

Amazon Prime

A lot of the gift cards you get as perks will likely be redeemed at Amazon (unless you really like Winners or Tim Horton’s). You will also get an extra $99 (enough to subscribe to Prime) each year if you maintain Platinum status.

Points

In order to get to Platinum, you need to make it to 10,000 points each year. The main way to do this is:

- Annual health check and blood test for your blood pressure, cholesterol, blood sugar – 4500 points

- Declaring that you don’t smoke – 1000 points

- Athletic events – like 500 points for running a marathon

- Dental cleanings and vaccines – 200 points each

- Step counts and sleep data from smartwatch

- 5,000 steps – 10 points

- 10,000 steps – 20 points

- 15,000 steps – 30 points

- 7 hours of sleep – 5 points

In 2024, I got 17,600 points easily passing the 10,000 target for Platinum status. Giving your life insurance provider your step counts, sleep data, and blood test results might seem a little Big Brother, but I appreciate the incentive to keep active and without the annual blood test I would have no idea what my numbers are.

Total Saving

In the past 12 months, I’ve spent $574 on insurance premiums but gotten $1182 back – most of that in hotel discounts. It’s almost like Vitality is paying me to travel the world.

My wife’s insurance premiums are half of mine, but she gets the same perks and has earned similar rewards to mine, so she’s doing even better.

So overall, Vitality is a great deal. I get the peace of mind that life insurance provides – a little bit of financial security for my family if something tragic were to happen. I also get the rewards and encouragement to stay healthy and active. And as long as I do, I get a ton of travel discounts that encourage me to see the world. Amazing.

Note: This isn’t an endorsed post. Manulife didn’t ask me to write this. If anything, I’m a little worried that if they realize how much money they are losing on me they might cancel my policy.

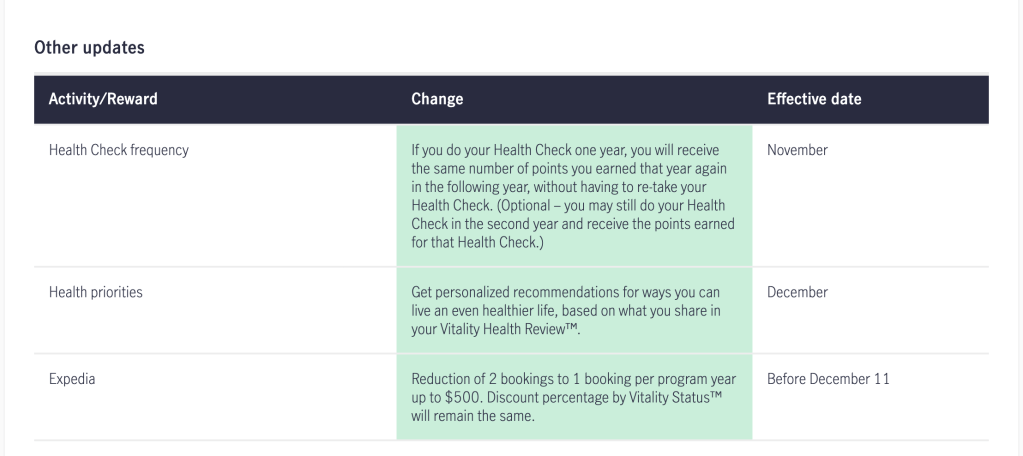

Updates

November 17, 2025

I hope Manulife didn’t read this and decide to make the rewards less lucrative. They just announced that Expedia rewards would be reduced to a 1 hotel stay up to $500 (down from 2). So that effectively gets rid of $200-500 in rewards I took advantage of each year.

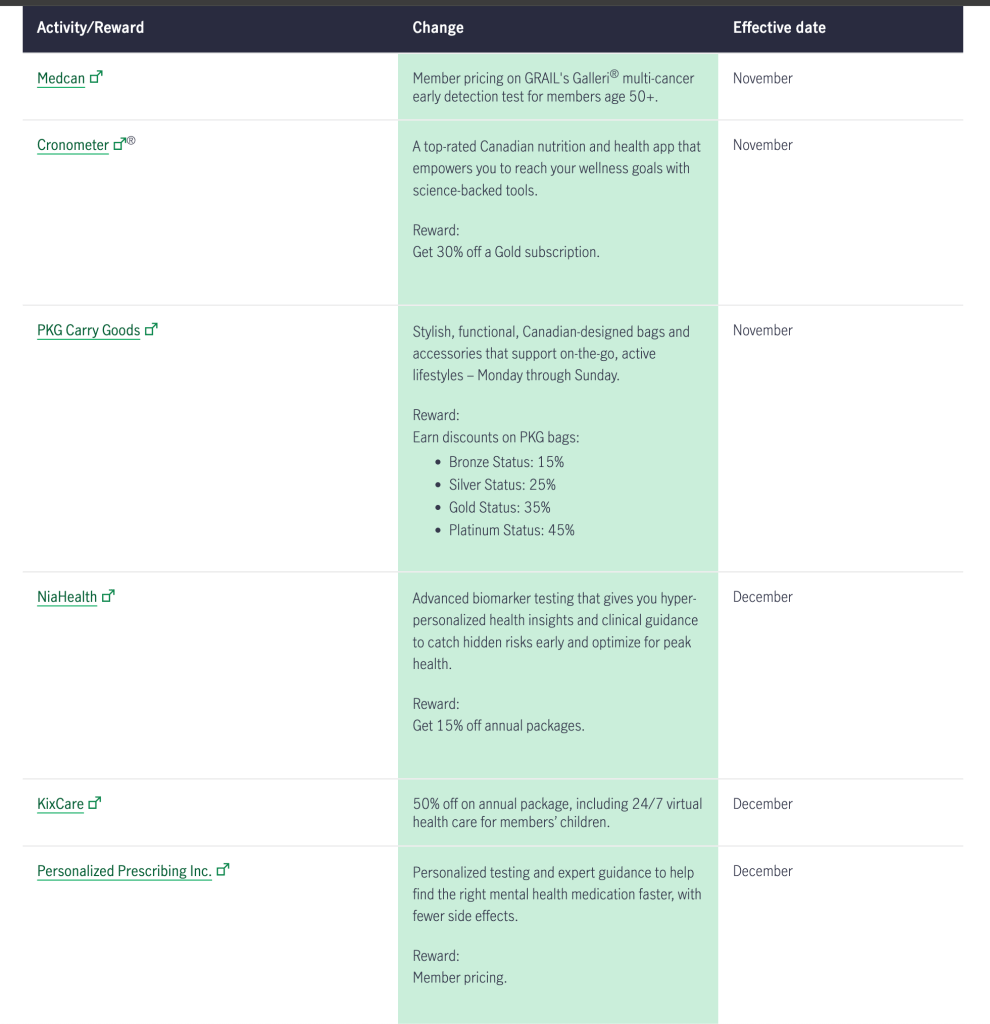

They also added some minor rewards, but not anything that looks immediately useful.

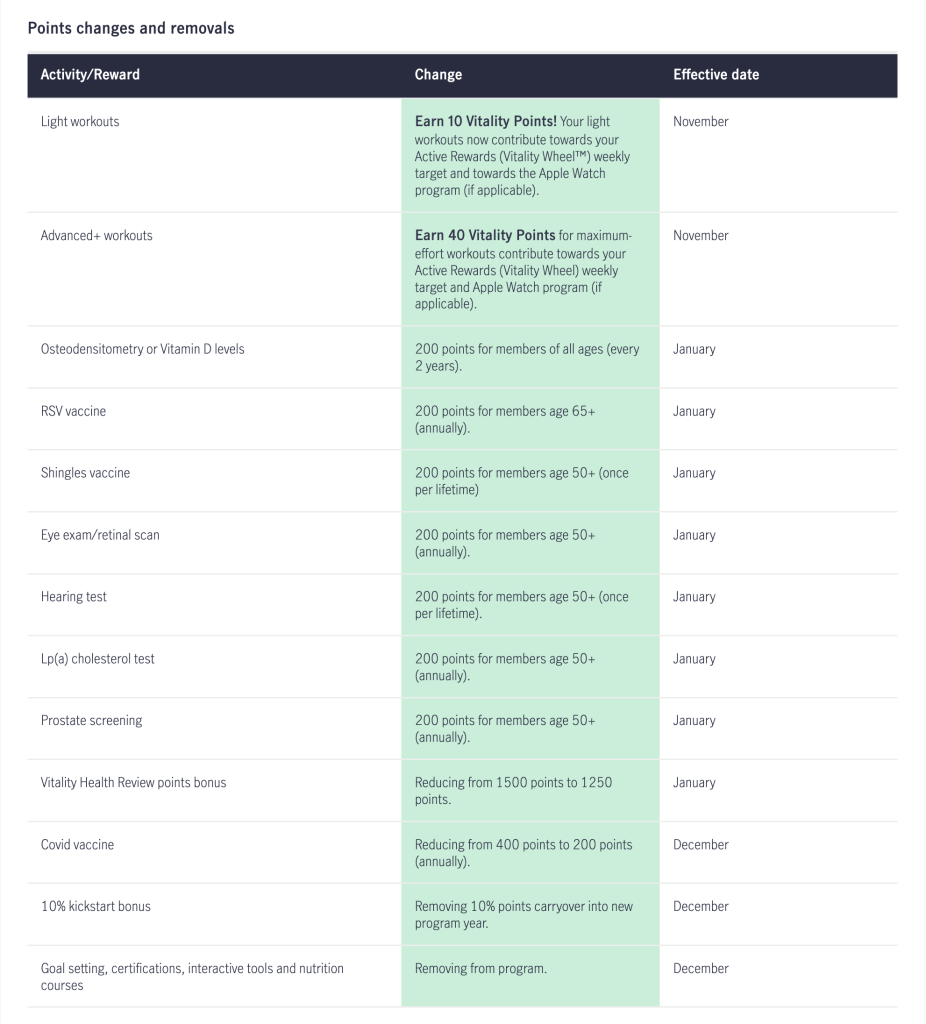

And they changed the points for a lot of things, including getting rid of the 10% carryover, which reduces the incentive to keep earning points once you’ve reached Platinum status.

This is fascinating to me. I hadn’t heard of this. I’m going to do some research! Appreciate the post!

LikeLike

[…] We saved $1800 on hotels (full price listed above) using vouchers from our life insurance. […]

LikeLike